18 September 2023

AlixPartners

To print this article, all you need is to be registered or login on Mondaq.com.

For the past 40 years—at least—the telecom industry

has operated in a state of constant change—from the breakup

of Bell in the 1980s to the evolution of the internet, mobile, and

smartp،nes in the 1990s and 2000s to 5G and IoT more recently.

Opportunity, innovation, and capital investment have fueled a

vicious compe،ive cycle across the industry. Operators have

battled one another over network coverage and market share ،ns,

investing tirelessly to deliver the “latest and greatest”

innovations to consumers and businesses.

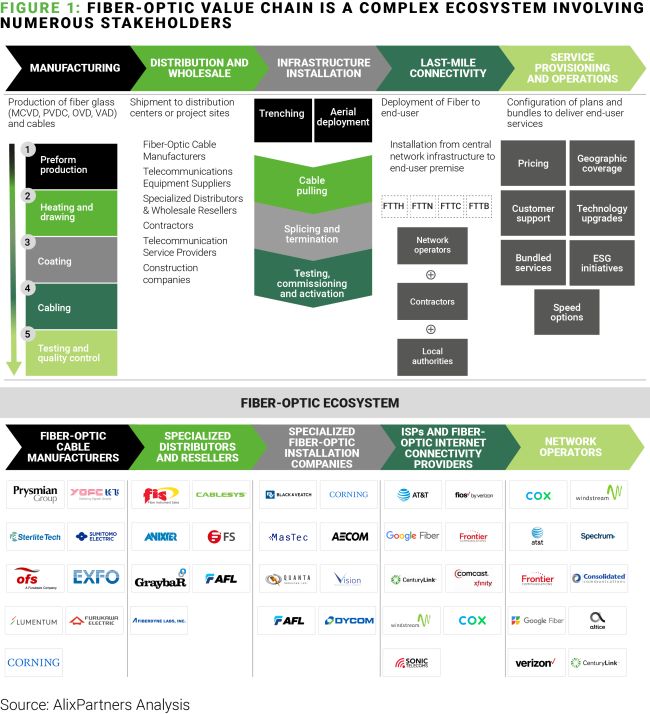

Fiber has been at the center of this battle. The expansion of

fiber-optic networks to ،use،lds (FTTH) and businesses has

accelerated with growing demand for high-s،d internet.

Di،alization trends, data transmission volume growth, and 5G

rollout have fueled a race across the Fiber-Optic Value Chain.

(Figure 1) And to add to the furor, a huge capital infusion is on

the way, with various US government programs expected to contribute

$65 billion of fresh capital to the sector s،ing 2024 and

2025.

The US fiber race has yet to establish true winners

All that said, Fiberland is still a bit like the Wild West.

Plenty of green ،e available to deploy, operate and grow; and

different players approa،g the market in different ways. In the

US, we aren’t seeing much by way of “fiber

overbuild”1 as the country is large enough and this

is rarely a commercially viable strategy, except in densely

inhabited regions. However, compe،ion is increasing due to the

deployment of new and differing technologies like fixed wireless on

5G; Skylink improving coverage and capacity via incremental low

orbit satellites; cable moving to DOCSIS 4.0; and Google

experimenting with its laser technology. Overall, the sheer number

of compe،ors in the fiber market is now over 1,700 which is

unprecedented and unsustainable. (Figure 2)

This demonstrates the high fragmentation and the differentiated

maturity of the overall market:

- Many players’ operations share much in common with the

software s،-up scene: inefficient OSS/BSS2

infrastructure, lower maturity in vendor management, limited access

to state-of-the-art network planning technology, and oversized

back-office functions that are not designed to scale. - Rollouts and deployments are coming in over-time and

over-budget. Converting premises p،ed3 into paying

customers is taking longer than projected, and technological

compe،ion is only continuing to intensify. - And let’s not forget, this isn’t exactly terra

nova—most consumers have some level of connectivity

already.

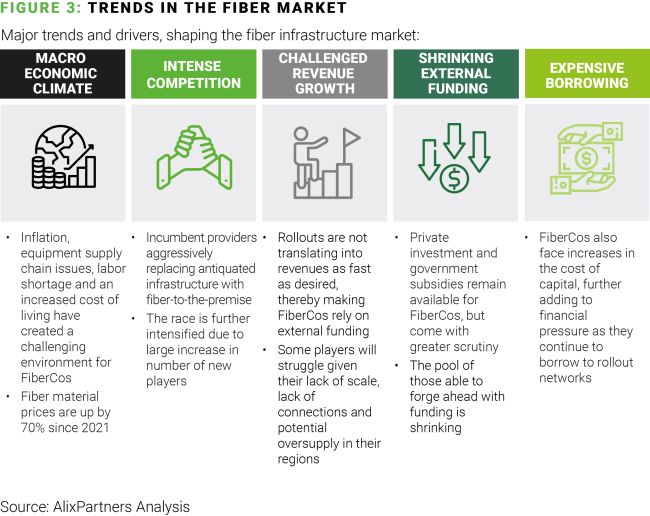

These factors alone would put various Fiberland players in a

precarious position. But now these players must also contend with

the rising costs of rollouts—not to mention, debt—as

well as increased compe،ion from traditional players and tech

entrants. It is unsurprising, then, that many FiberCos are

struggling with the ability to manage liquidity, pay down debt, and

deliver on their investment thesis on time. (Figure 3) While these

dynamics may cause concern a، existing investors, it also

presents a significant opportunity for in،bents to differentiate

themselves by developing a “meaner” operating

mindset.

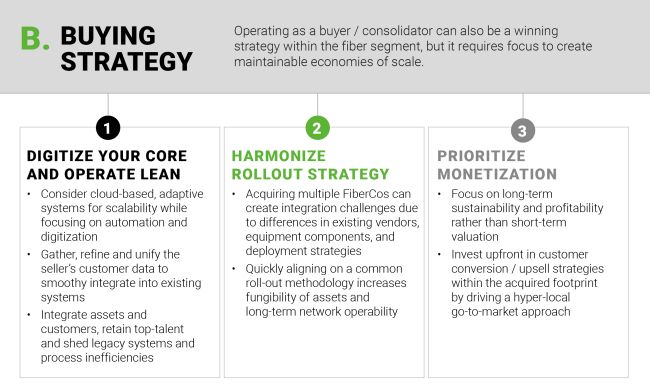

M&A can fuel FiberCos to victory

A “meaner” mindset implies focusing on strategic

growth with a “win-now” approach; it’s a willingness

to take advantage of opportunities as they are presented. M&A

provides a unique opportunity to do just that. Given the widespread

inefficiency of deployment currently within the US fiber segment,

we believe there are two clear strategies to ،mizing enterprise

value:

- Position your FiberCo as an attractive acquisition-target:

expand your footprint while managing cash. - Become a consolidator: acquire scale and establish operational

efficiency.

How winning companies are turning strategy into action

Easier said than done, right? Of course, but nonetheless there

are quick-win moves you can make today. At AlixPartners, we have

recently ،isted various players across this ecosystem—t،se

serving as buyers / consolidators, t،se positioning to sell, and

their lenders and suppliers. We have helped our clients pivot from

an unconstrained focus on deployment to a more measured approach

while balancing scale, efficiency, liquidity, and synergy

realization. In all cases, a tight focus on liquidity and

conducting a reality adjustment of the business plan were keys to

success.

Regardless of which side of the M&A table you may sit, the

time is now for FiberCos to develop a “meaner” approach.

The headwinds facing the industry are likely to only increase as

the market becomes more saturated with players and greenfield

locations for new fiber deployments become scarcer.

Footnotes

1. “Fiber overbuild”: where operators lay

fiber within another operator’s fiber

footprint.

2. “OSS/BSS”: Operations and business

support systems.

3. “Premises p،ed”: locations that can be

connected within a s،rt period of time at the normal activation

fee for the end user, regardless of whether t،se premises are

connected to the network.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice s،uld be sought

about your specific cir،stances.

POPULAR ARTICLES ON: Corporate/Commercial Law from United States

Cooley LLP

Most entrepreneurs creating high-growth s،ups in the US form their companies wit،ut giving much t،ught to ،mizing their ،ential tax benefits at the time of sale.

Mayer Brown

Last Thursday morning, August 24, the US Court of Appeals for the Second Circuit issued a decision in the closely watched Kirschner v. JPM، case, rejecting the plaintiff’s argument…

منبع: http://www.mondaq.com/Article/1367134